New w4 paycheck calculator

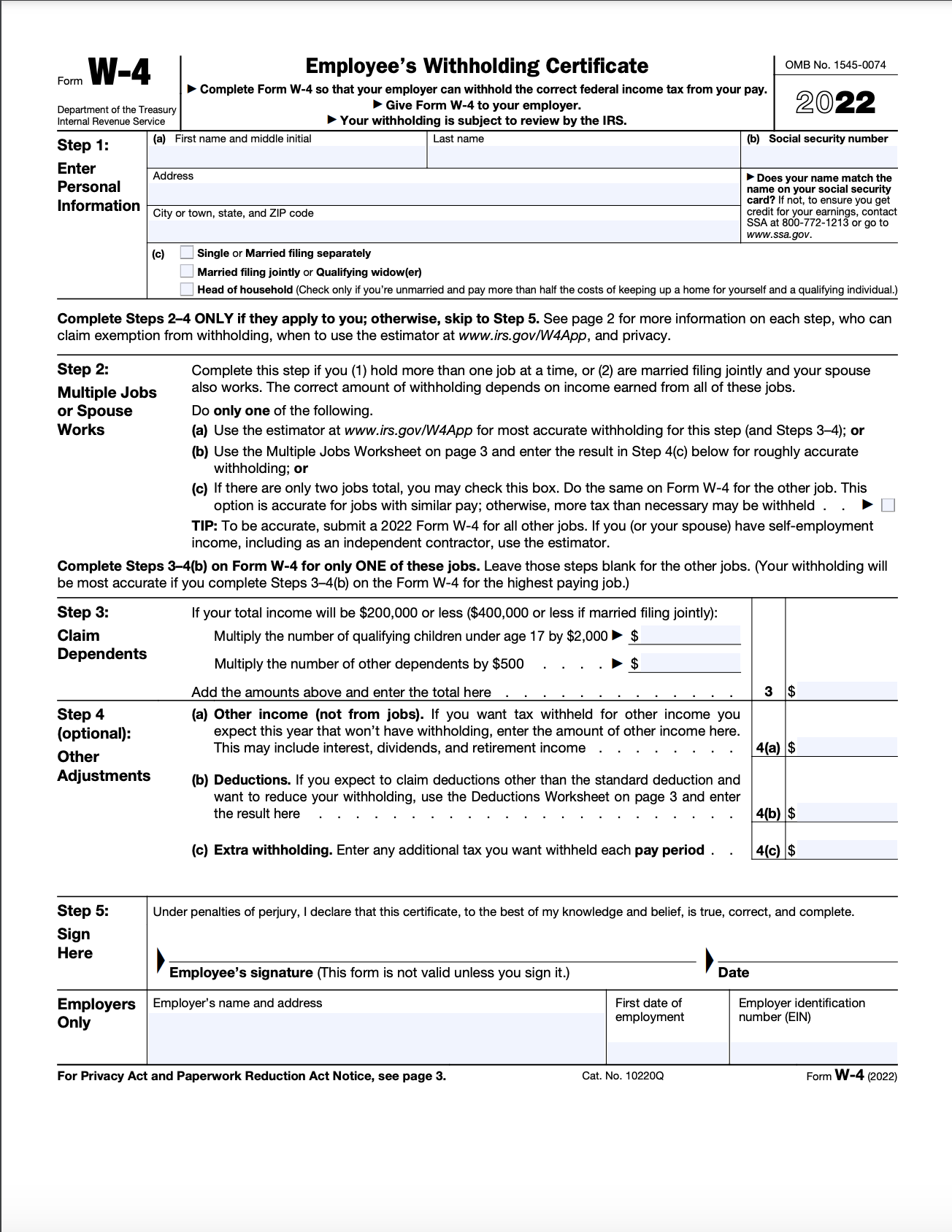

Updated Withholding Calculator Form W-4 Released. Subtract the value of Withholding Allowances claimed for 2022 this is 4300.

Irs New Form W 4 For 2021 Employee Tax Withholdings Bernieportal

How Your Paycheck Works.

. Use the Paycheck Calculator or W-4 Creator below and at the end of the calculation in section P163 you will see your per paycheck tax withholding amount based on your selected pay. Ad Create professional looking paystubs. Figure out which withholdings work.

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Use your estimate to change your tax withholding amount on Form W-4.

This number is the gross pay per pay period. In a few easy steps you can create your own paystubs and have them sent to your email. Your W-4 impacts how much money you receive in every paycheck your potential tax refund and it can be changed anytime.

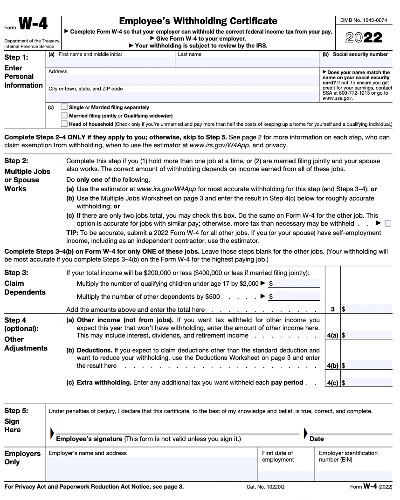

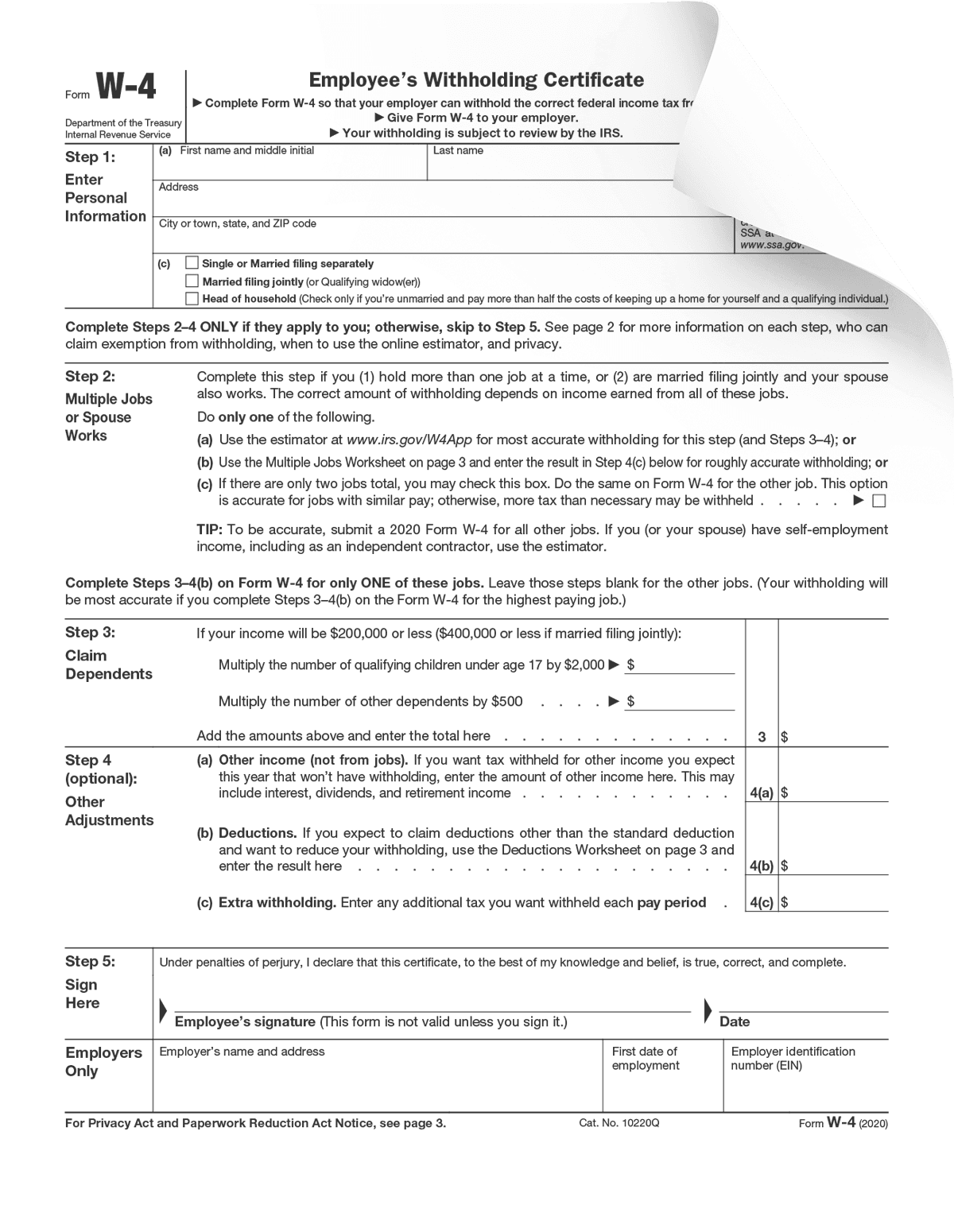

The Form W4 provides your employer with the details on how much federal and in some cases state and local tax should be withheld from your paycheck. Just enter the wages tax withholdings and other information required. Enter your new tax withholding.

Use our W-4 calculator. Subtract any deductions and. If you complete a new Form W-4 you should submit it to your employer as soon as possible.

Calculator Helps Taxpayers Review. We use the most recent and accurate information. This paycheck calculator will help you determine how much your additional withholding should be.

But calculating your weekly take. Welcome to the W4 Calculator. When you start a new job or get a raise youll agree to either an hourly wage or an annual salary.

Use ADPs New York Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. To change your tax withholding amount. Or keep the same amount.

Another way to manipulate the size of your paycheck - and save on taxes in the process -. The Withholding Calculator asks taxpayers to estimate their 2018 income and other items that affect their taxes including the number of children claimed for the Child Tax.

Paycheck Calculator Online For Per Pay Period Create W 4

Check Out The New W 4 Tax Withholding Form Really Business Berkshireeagle Com

Federal And State W 4 Rules

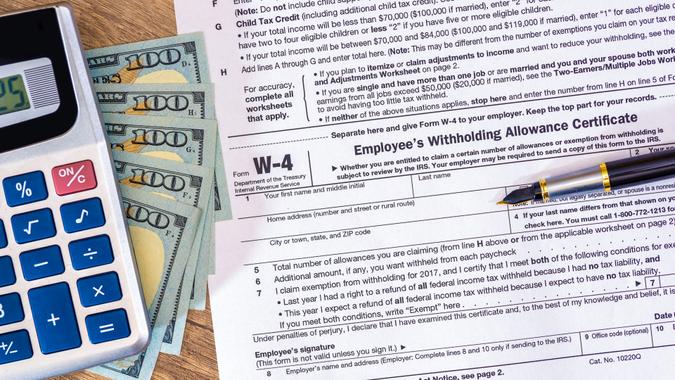

How To Calculate 2020 Federal Income Withhold Manually With New 2020 W4 Form

What Is A W 4 Form How It Works Helping Your Employees Complete It

How To Fill Out A W 4 A Complete Guide Gobankingrates

W 4 Form Basics Changes How To Fill One Out

Learn About The New W 4 Form Plus Our Free Calculators Are Here To Help Paycheck Manager

Learn About The New W 4 Form Plus Our Free Calculators Are Here To Help Paycheck Manager

Paycheck Tax Withholding Calculator For W 4 Tax Planning

Tax Information Career Training Usa Interexchange

How Do I Fill Out The 2019 W 4 Calculate Withholding Allowances Gusto

W 4 Form What It Is How To Fill It Out Nerdwallet

W 4 Form What It Is How To Fill It Out Nerdwallet W4 Tax Form Tax Forms Changing Jobs

Paycheck Tax Withholding Calculator For W 4 Tax Planning

Learn About The New W 4 Form Plus Our Free Calculators Are Here To Help Paycheck Manager

Form W 4 Form Pros